Equity Distribution and Goodwill in Startups | Company Valuation and Shareholding

How is equity distributed in startups and the impact on Goodwill and Company Valuation

We could have also titled this page on valuing your startup as "last but not least," because this is one of the most important aspects that will need to be negotiated before the investor will proceed with the actual investment. To address this, we need to introduce two more concepts: pre-money valuation and post-money valuation.

- Pre-money valuation is the value of the company before a new investment is made.

- Post-money valuation is the value of the company after a new investment is made.

Let's return to our Newco, which is set to produce the iChic. As we saw on the page about the cost method, the value of the project before the investment was about 320,000 Dollars + Goodwill. But in the meantime, you haven't been lazy, and you've managed to gather some additional funds from friends and family (almost 400,000 Dollars). You've also hired some employees and even a financial director who all see potential in the project and have invested some of their own money. In total, 1,000 shares have been issued. Additionally, you've secured a substantial grant (usually doubling the amount of capital already invested), bringing your valuation to 1,500,000 Dollars + Goodwill. Again, we have no idea how much the goodwill is; however, it's evident that potential prospects for a highly successful product must be worth something. Let's note that without goodwill, the price per share is therefore 1,500,000 Dollars / 1,000 shares = 1,500 Dollars.

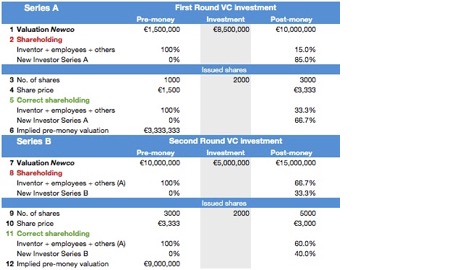

Now, suppose you succeed in finding a venture capital firm that approves your business plan, is satisfied with the management team and advisors, and indeed sees your invention as the next "need to have." Let's take a look at the capitalization table below.

A "capitalization table" is a spreadsheet that shows a company's ownership structure by displaying the distribution of equity and shares. This document provides insight into who owns what percentage of the company and how the shares are distributed among investors, employees, and founders.

Typically, different investment rounds are labeled with letters A, B, C, and so on. There can be many investment rounds, but in practice, there are usually no more than four or five. We start with row 1, the pre- and post-money valuations of Newco. The pre-money valuation is set at 1.5 million Dollars (we don't know the goodwill), and the post-money valuation at:

1.5 million Dollars + 8.5 million Dollars = 10 million Dollars.

The next row (2) shows the share percentage that would be assigned based on the capital distribution before and after the funding round. At first glance, it's a simple calculation; it turns out that after the investment, 15% of the shares remain in the hands of the original shareholders, and 85% goes to the new Series A investors. But is this entirely accurate? As noted several times before, we haven't yet factored in goodwill in our calculation. We have intentionally delayed this until the end, and now it's time to delve into this before we proceed with the capitalization table.

Table 1: Capitalization table of your startup

Goodwill: The "intangible asset" on the balance sheet

If you Google the definition of Goodwill, you will find many answers. Literally translated, it means "goodwill." Each definition is usually correct, but the collection of definitions can be confusing. We don't want to cause more confusion, but generally speaking, we can define goodwill as:

Goodwill = Price for the company minus net assets

In other words, goodwill is the extra amount paid by the buyer of a business; or, the added value of a company above its net assets. Why is this? We can easily explain this by imagining the purchase of a pizzeria. When you buy a pizzeria, you're not just buying the building, the furniture, the pizza oven, kitchen equipment, etc., but you also get access to the experienced staff (e.g., the excellent and always cheerful pizza chef), the customers, the licenses, and the brand recognition. This, of course, has value too, and this value is summarized in the term goodwill.

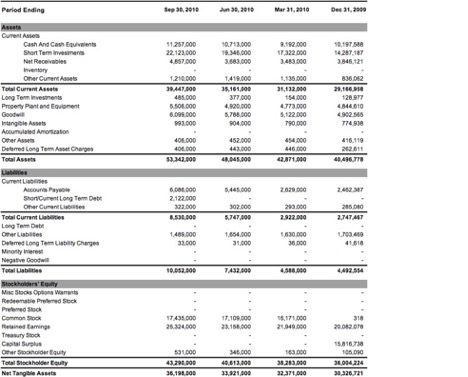

Goodwill can be a significant part of the assets for companies about to launch their innovation. For established companies, this varies greatly. The table below illustrates the concept of goodwill with the balance sheet of Google Inc. from 2010. This balance sheet is old, but for the example, it doesn't matter, and you should take a moment to absorb the numbers. The amounts are in '000, so, for example, as of Sep 30, 2010, "Total Assets" were valued at $53.34 billion, of which Goodwill made up about $6.1 billion. By the way, Google was sitting on a mountain of cash of no less than $33.3 billion (Cash + Short Term Investments) in 2010, which was already an enormous amount of money at that time.

But this aside. Now that you know what goodwill is, let's return to our problem; you've found an investor, and the question now is, how much should you sell your startup (called Newco) for?

Figure 2: The balance sheet of Google, Inc. in 2010

Newco's goodwill and price: Series A investment

In the case of Newco, the goodwill is essentially the invention, the innovation, and especially the potential to make a lot of money from it. The question of how much Newco should actually be sold for is answered in rows (3 - 6) of the above capitalization table, i.e., the number of new shares that will be issued for the investment of 8.5 million Dollars. This might be one of the most important points during the negotiations. Here, not only the ownership of Newco is negotiated, but also its value.

In this example, let's assume you manage to negotiate the following: 2,000 new shares will be issued for 8.5 million Dollars. This means that there are now a total of 3,000 shares outstanding, representing a total value of 10 million Dollars (there are no debts or loans). The price per share is therefore 10 million Dollars / 3,000 shares = 3,333 Dollars. At the same time, the original shareholders' stake has been reduced from 100% to 33%. Still a step back (understandable considering the Series A investor has put in nearly six times more money than the original shareholders), but less than the reduction from 100% to 15%, which we had previously calculated by only looking at the sums of money. The Series A investors, in turn, receive 66.7% of the shares; this was 85% with the monetary calculation. What happened here? What happened is that both the Series A investor and the original owners, including yourself, agreed that 2,000 shares would be issued for 8.5 million Dollars. This means that Newco was valued at 3,333,333 Dollars before the capital injection, which means that goodwill of 3,333,333 Dollars - 1,500,000 Dollars = 1,833,333 Dollars was paid. This goodwill, both parties reason, is justified by the exceptional invention.

However, the investor may impose certain conditions in exchange. These conditions can range from veto rights during board meetings to appointing a director or manager of their choice, although this does not play a role in this case since the investor already gains the majority of shares with this hypothetical transaction. If you're wondering whether goodwill will always be paid, the answer is a resounding, no! Read on.

Newco's badwill and price: Series B investment

During the negotiations of a funding round, not only is the number of shares for the investment amount discussed, but also the results to be achieved during Newco's development process, also known as milestones. These milestones are essentially the benchmarks against which Newco's progress is measured according to the (business) plan. However, it often happens that these milestones are not met on time, meaning more money is needed to move the project forward. This does not mean that some extra cash will be casually injected into the company: quite the opposite. Before this happens, a critical look is taken at the reasons why the milestones were not met, and questions are asked, such as, is the technology solid; is the management capable of leading Newco; are the market conditions still the same as at the start of the project, etc. etc.

In any case, it is generally not a good sign if the milestones are not met on time or at all, and a decision will need to be made on whether to continue the Newco project, and if so, how much additional funding is required and by whom. I emphasize “by whom” because it is not always a given that the current shareholders are willing or able to finance further. It is clear that Newco's risk profile has increased, which could even mean that the Series A investor may not be allowed (due to the fund's statutes) or willing to make further investments, and a new investor might need to be found for Series B.

Let's assume that this succeeds. A new investor is found who is willing to invest 5 million Dollars in Newco in exchange for 2,000 shares. This is illustrated in rows (7 - 12) of the capitalization table. Again, we see that if we use the sums of money to calculate the share distribution, we get a different answer than if we consider the number of shares. Firstly, the ownership is not divided according to the proportions of 33.3% - 66.7%, but 40% - 60%, meaning the investors receive more than would be calculated based on the sums of money alone. This means that the implied pre-money valuation is lower, i.e., 9 million Dollars instead of 10 million Dollars. In other words, you and your original co-investors, as well as the Series A investors, are effectively penalized for the fact that the milestones were not achieved. A warning, therefore.

Startup Valuation: Conclusions

We have now come to the end of our introduction to the valuation of a startup. We have summarized entire books across more than 10 web pages and often simplified things significantly to avoid losing sight of the bigger picture. Although we have tried to keep it as simple as possible, many readers will still find this quite a complex topic. And it is. Furthermore, as we said at the beginning, it is not our intention to turn the reader into a “full-fledged” financial analyst. What we wanted to achieve is to give you a good idea of what an investor looks at and how they see the value of your startup, Newco, the producer of the iCic, in the future. The value of Newco, as calculated in the example using the DCF method, can only be assigned after one or more investors have invested $10 million. If this investment is not made, the value is limited only to the R&D costs incurred so far. Therefore, it is paramount to secure funding to set up Newco. On the next page, we will briefly discuss another, more sophisticated, valuation method: the monte carlo simulation.