Comparable Analysis for Valuation of a Tech Startup

Comparable analysis is a widely used method for determining business value. Learn how to apply it for valuing a tech startup.

In the previous section, we laid the foundation for the methods you can use to determine the value of a business entity. This can be a company, a business idea, an invention, or a project. We continue with the method called Comparables Analysis. This method is based on the assumption that companies with similar characteristics should have similar ratios or multiples. Commonly used multiples are the price earnings (PE) ratio, price to book, and enterprise value to EBITDA, but these are certainly not the only ones that can be used. We illustrate the Comparables Method with the following example:

Comparables Table

The table above summarizes the financial information of several companies with similar characteristics. The first column contains the data of the "new company," Newco, the company we want to value. The other four columns contain the data and value of four different but comparable companies. With this information, we can now calculate the implied value of Newco.

EV is the Enterprise Value, and BV is defined as Book Value. The Enterprise Value is the total value of the company. Suppose a company is financed by $2 million in loans (Debt), and the market value of the equity, the so-called Market Cap, is $3 million, then the EV is equal to $5 million. Note that EV and Market Cap are the two magnitudes we are looking for.

Newco's outstanding loans are only $200K. This will indeed be very low in most cases for startups financed with VC (Venture Capital) or PE (Private Equity) funds. These types of investors prefer no debt in a company and will require the financing structure to be cleaned up during an equity purchase. The table below shows the implicit value of Newco by applying each multiple of the four companies 1 - 4 to the various financial magnitudes of Newco.

Implicit Values for Newco (in mln)

As you can see, the implicit values vary significantly, ranging from 67 million to 200 million. To reach a satisfactory conclusion, you will need to delve further into the characteristics of the four companies to uncover any other factors that may provide more information. This example indicates that a value for Newco around 110 million is likely a reasonable estimate.

The reader might wonder if this method is not somewhat simplistic. The opposite is true, and in practice, it is often the case that Venture Capitalists do not go much further than a Comparables Analysis. This is especially common in situations where it is nearly impossible to apply more rigorous valuation methods due to a lack of data. As you have seen, the Comparables method is not particularly complex. However, finding suitable comparison material can sometimes be challenging, although specialized VC or PE firms in certain industry sectors can quickly provide a value for Newco. In the next part, we will continue with the valuation of our small company Newco and actually calculate a so-called exit value. This is the value the company will yield upon sale, which is, of course, what an investor is interested in.

Does this also work for your tech startup? A valid question. The iChic hasn't even been launched on the market yet, so there's no revenue for Newco, let alone EBIT or EBITDA. The reason we've shown this method is that it can be used to calculate a so-called Exit Value. This is important when considering a potential acquisition of your company.

Acquisition of a company: Hello & Goodbye or what is the value and the return?

As the name suggests, the 'exit value' of a company is the value it will yield upon sale. This may seem a bit strange; after all, we are in the process of determining a value for a fledgling company that still needs funding to get started. And yet, we're already talking about an "exit"? Indeed. When a venture capital firm visits you (and you've come quite far by then), they already have an exit strategy in mind from the moment they greet you. This strategy is aimed at exiting the investment profitably. That's the goal of an investment: to make a profit. In the world of venture capital (VC) and private equity (PE), it's akin to the Lennon & McCartney composition, "Hello, Goodbye."

The most common "Exit Strategies" are acquisition by a large company, or an Initial Public Offering (IPO). An IPO involves issuing shares to the public, usually resulting in a stock market listing. During the "exit," the highest value is generated for current shareholders, including you as the inventor and other employees who hold options or shares in Newco. This naturally applies to co-investors as well, such as venture capital and private equity firms. This is the moment when real gains are realized and your dream comes true. Hence, it's clear that the Exit Value is one of the most critical data points for an investor.

Acquisition of a company and economic value

In this section, we will cover the most robust method among all valuation methods to calculate an Exit Value, namely the Discounted Cash Flow (DCF) method. We have already introduced the mechanism of the DCF method earlier, and now we will discuss the steps taken to determine the value of Newco, which will soon launch the iCic into the market and thus needs to scale up production.

Acquisition of a company and budget

Firstly, a budget needs to be created to outline future revenues, expenses, and cash flows. The table below summarizes the hypothetical budget of Newco over a period of 10 years. It should be noted that in reality, such a table would be much more detailed. If you were to present something like this to a VC, they would immediately say that it looks more like a hastily put together table than a serious budget and forecast. And that's precisely the case; the table is only intended to illustrate the DCF method.

"Budget NewCo"

As you can see, the period of 10 years is divided into three parts. We will discuss each of these separately before proceeding with the valuation.

1. Venture Period.

The first four years constitute the Venture Period. This is the phase where substantial investment is required to scale up production and launch the product, iChic, on a large scale in the market. What you should note is that during this period, cash flows are negative. The sum of these cash flows, minus $10 million, represents the amount that the VC or PE firm needs to invest for Newco to successfully enter the market. During this period, except towards the end, there are no revenues; there are only costs which are covered by the investment.

This is the most crucial period for a new company. It's during this time that most companies fail, whether due to the product (iChic) being a flop, regulatory issues preventing production, lack of market interest, or functionality issues—whatever you can imagine.

We assume that iChic gains traction. At the end of a successful venture period, the company will be sold to a large corporation interested in integrating the product into its own lineup. In the case of iChic, this could be Apple (just an example). Alternatively, Newco could go public through an IPO or stock market listing, remaining an independent entity. In any case, it's during the exit year that we determine the company's value. After all, if we intend to sell it partially or entirely, we need to be able to put a price tag on it.

2. Rapid Growth Rate Period.

This is followed by a period of very rapid growth, known as the Rapid Growth Rate Period. Demand for the product increases sharply, leading to a rapid rise in revenues. During this period, investment will still be necessary to finance further expansion, but it will primarily come from internal resources.

3. Stable Growth Rate Period.

Next comes a period of stable growth, or the Stable Growth Rate Period. Revenues now grow at a rate slightly above inflation, largely due to the product's brand recognition. Generally, a stable growth rate (g) of 3% is assumed.

After this introduction, we will now proceed to calculate the value of the startup NewCo.

So,hHow do we perform a valuation of the startup Newco? From the section on the DCF method, readers will conclude that we need to discount cash flows to obtain an NPV. That's correct, but which cash flows exactly? At first glance, it seems reasonable to discount cash flows from year 1 to year 10. The question then arises about what happens to Newco after year 10; indeed, cash flows will still come in, but we do not account for them because the table does not extend further. Here's where some mathematical help comes in, and we introduce the concept of Graduation Value to complete the valuation.

Graduation Value and NPVexit

We can best illustrate the principle of Graduation Value (GV) with an example. Suppose the current interest or discount rate, r, is 10%, and your grandmother has $1 million tucked under the mattress (earning no interest or other income). How much is that million euros worth in today's money terms after 100 years? You know the formula, so you plug in:

Therefore, cash flows received far into the future are not worth much in today's terms. Discounted Cash Flows actually form a converging series that approaches zero as t = ∞. This converging series is summarized as follows:

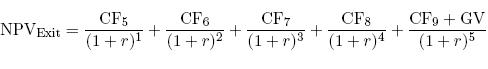

where r is the discount rate and g is the stable growth rate, representing the annual percentage growth in revenues. S is the last year of the Rapid Growth Period. All cash flows from year S onward are encapsulated by this formula. The method to calculate NPVExit is as follows: we envision Newco, T years into the future, and determine the duration of the rapid growth period. We then discount the cash flows from year T to year S, the end of the rapid growth period, and add the GV to CFS as follows:

Table: "Value of the startup Newco"

The table above illustrates this. Note that for the power t in the denominator, we do not take 5; 6; ... 9, but t = 1 to t = 5, since we want to determine the NPV for the exit year T. The discount rate, r, is found in the cost of capital table and we decide to use riCic = 12.78% considering iCic as Entertainment Tech. Now, for the value of Newco in exit year T, we get a value of $674 million. This is an important result, but not entirely accurate for the investor who can only cash in after T years. Therefore, we need to discount the NPV back to year 1. But which discount rate do we use for this? Contrary to what most people think, it's not the same discount rate used to discount Newco's cash flows, but the discount rate used by the VC (assuming the VC is the investor) or whichever investor with their corresponding r. According to A. Metrick in his standard work "Venture Capital and the Finance of Innovation," rvc is taken as 15%, giving an NPV for the VC of $386 million.

An acquisition of the startup? The details

That looks good. Your company could be worth hundreds of millions. However, there are two "details" to mention. First, everything must go as projected in the budget, which is often uncertain. Secondly, it's important to realize that these values we've calculated are valid only after finding investors willing to invest $10 million to develop Newco to reach the Rapid Growth Rate phase. Without this investment, Newco is only worth the costs incurred up to that point, as we calculated earlier, only $320,000. Thus, finding investors is crucial. This is a challenging task that requires understanding of how investors, Venture Capitalists, Private Equity firms, Angel investors, should be approached.